For importers bringing cargo and goods into the United States, importing can seem daunting if not overwhelming at times.

This is compounded by the fact that duties are assessed by Customs and Border Protection and must be paid to allow entry of those goods into the country.

A customs broker will need to use a tariff or Harmonized Tariff Schedule (HTS) in order to determine the duty percentage that will be owed on the shipment.

Typically, when importers receive commercial documents from their suppliers or freight forwarders, a classification code or HTS is sometimes provided on the documentation up to six numerical digits in length. A common miscommunication occurs where the shipper or overseas supplier is providing the importer with a Schedule B number and not the required HTS.

While similar in appearance, a Schedule B number is used when exporting cargo from the United States into other countries and is determined by the US Census Bureau.

Schedule B numbers and HTS numbers are similar, but have key distinctions that set them apart from each other.

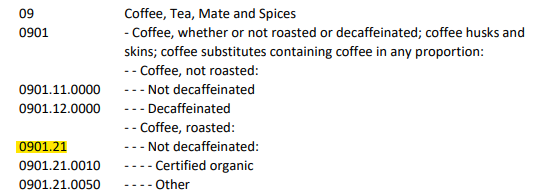

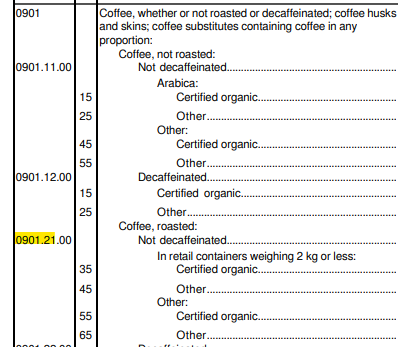

For example, when classifying a commodity such as coffee which has been roasted; is not decaffeinated; and is not certified organic, your supplier may give you 0901.21. This is correct for both the HTS classification and the Schedule B classification for roasted coffee not decaffeinated as noted in the screenshots below.

SCHEDULE B

HTS

Looking further into this, differences can be spotted between the two types of duty classification when brought out to the required tenth digit to assess duty rates.

The Schedule B number for our roasted not decaffeinated non-organic coffee would end in 0050. The HTS for import classification goes into more detail, however. Here, we must also determine whether the product is in retail containers weighing 2 kg or less (0045). If the product falls outside those parameters and is either packaged with roasted coffee weighing more than 2 kg, OR is packaged in something other than a retail container (0065).

Licensed Customs Brokers help alleviate any confusion when dealing with your HTS and the duties that are owed to US Customs and Border Protection. With Ruyle International, you can trust that your products are thoroughly and accurately classified by an experienced and licensed professional.